Fsa Faq 2024. The city of new york offers its employees a flexible spending accounts (fsa) program, which is allowable under internal revenue code (irc) section 125. To apply for fsa, you should submit a completed dd form 1561,.

Beginning january 1, 2024, health care fsa contributions are limited by the irs to $3,200 each year. We are pleased to announce the.

But If You Do Have An Fsa In 2024, Here Are The Maximum Amounts You Can Contribute For 2024 (Tax Returns Normally Filed In 2025).

What is a flexible spending account?

We Are Pleased To Announce The.

Healthequity is the current administrator for paypal’s health spending account (hsa) and health reimbursement account (hra) programs.

2024 Flexible Spending Account (Fsa) Rules, Limits &Amp; Expenses.

Images References :

Source: www.wexinc.com

Source: www.wexinc.com

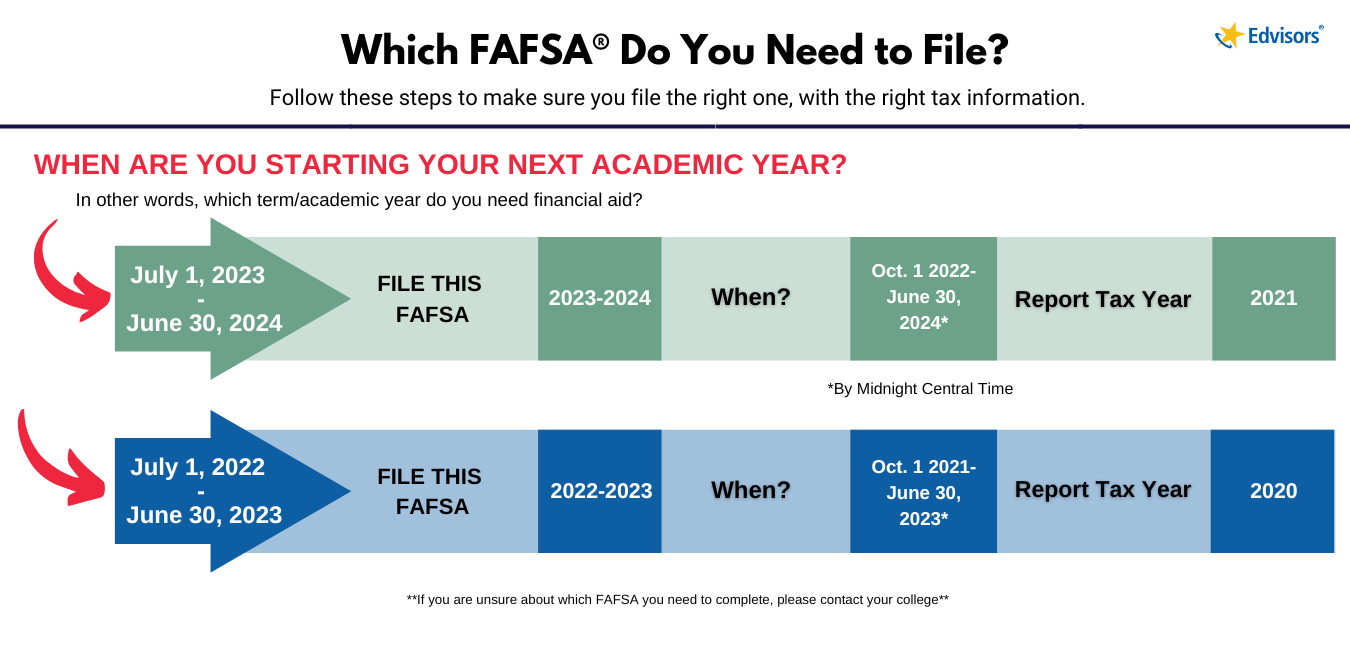

2023 FSA limits, commuter limits, and more are now available WEX Inc., Some states and colleges have their own deadlines for financial aid, so check for. For plans that allow a.

Source: www.edvisors.com

Source: www.edvisors.com

When is the FAFSA Deadline 20232024? Edvisors, Is this product fsa or hsa eligible? But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Source: scholarships360.org

Source: scholarships360.org

How to Complete the 20232024 FAFSA Scholarships360, I have broken most questions down into three sections. The free application for federal student aid (fafsa®) form gives you access to the largest source of financial aid—federal student aid.

Source: www.wexinc.com

Source: www.wexinc.com

HSA vs. FSA See How You’ll Save With Each WEX Inc., Can i use my fsa or hsa card here? But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Source: theadvisermagazine.com

Source: theadvisermagazine.com

Tax Benefits of Flexible Spending Accounts, Last updated march 31, 2022. Beginning january 1, 2024, health care fsa contributions are limited by the irs to $3,200 each year.

Source: completebenefitalliance.com

Source: completebenefitalliance.com

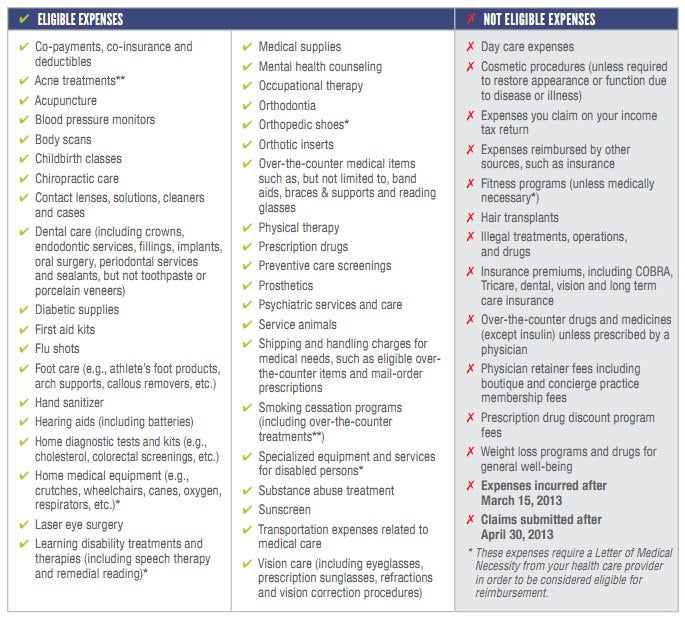

How to Use Your Flexible Savings Account to Save Money and Avoid, For plans that allow a. The city of new york offers its employees a flexible spending accounts (fsa) program, which is allowable under internal revenue code (irc) section 125.

Source: gogetcovered.com

Source: gogetcovered.com

IRS Releases 2023 Limits for Flexible Spending Accounts (FSA), Health, (this is a $150 increase from 2023 limit of $3,050.) the limit is per person;. Answers to questions about the fsa id process.

Source: andyqkerrill.pages.dev

Source: andyqkerrill.pages.dev

Fsa 2024 Contribution Limits Clara Demetra, The free application for federal student aid (fafsa®) form gives you access to the largest source of financial aid—federal student aid. 31, 2023— with some changes for you and your family.

Source: admin.itprice.com

Source: admin.itprice.com

Fsa 2023 Contribution Limits 2023 Calendar, Your contributors will each need their own studentaid.gov. The city of new york offers its employees a flexible spending accounts (fsa) program, which is allowable under internal revenue code (irc) section 125.

Source: www.ees-net.com

Source: www.ees-net.com

Employee Benefits EES, 31, 2023— with some changes for you and your family. Last updated march 31, 2022.

Healthequity Is The Current Administrator For Paypal’s Health Spending Account (Hsa) And Health Reimbursement Account (Hra) Programs.

Simplify flexible savings accounts for your employees.

The Annual Maximum Contribution To A Healthcare Fsa Will Increase From $3,050 To $3,200 For 2024.

Some states and colleges have their own deadlines for financial aid, so check for.